Initially your discover a merchant account because the a customer with First Government attempt to draw in one to top and you will that additional variety of ID. Every different ID need to be unexpired.

Home Guarantee Outlines

Permitting our locals set-out root ‘s the very reasoning i established all of our gates within the Higher Despair-though almost every other banking institutions had been compelled to personal. That’s strong-which will be still exactly who we’re. For over 85 age, we have went on for the reason that exact same spirit away from providing our very own all in help of your neighborhood.

Today, we offer the sort of safer, reputable home loans Ohio group have to build an effective basis money for hard times. All of our knowledgeable, knowledgeable party was fully invested in enabling bring your home ownership fantasies alive, meeting you exactly where youre having customized consultations.

Our professional loan officials provide the fuel of the years of experience-and an enthusiastic unwavering dedication to watching you succeed. From start to finish, i act as your ex, collaborating together with your builder to make certain everything is complete and you can over correct. We have been in the market away from strengthening you to definitely make, given that we’re doers-as you.

We have been here to prosper-and frequently that means helping you secure the fund and also make it occurs. Our house Security Contours give a flexible, safer, reasonable treatment for secure credit courtesy a mortgage in your family. Whether you’re renovating otherwise including into, while making an enormous buy, otherwise merging almost every other obligations, we have been happy to help you create a financial investment inside your self with property security line. Let us see what our very own strength will perform together.

Key Has actually

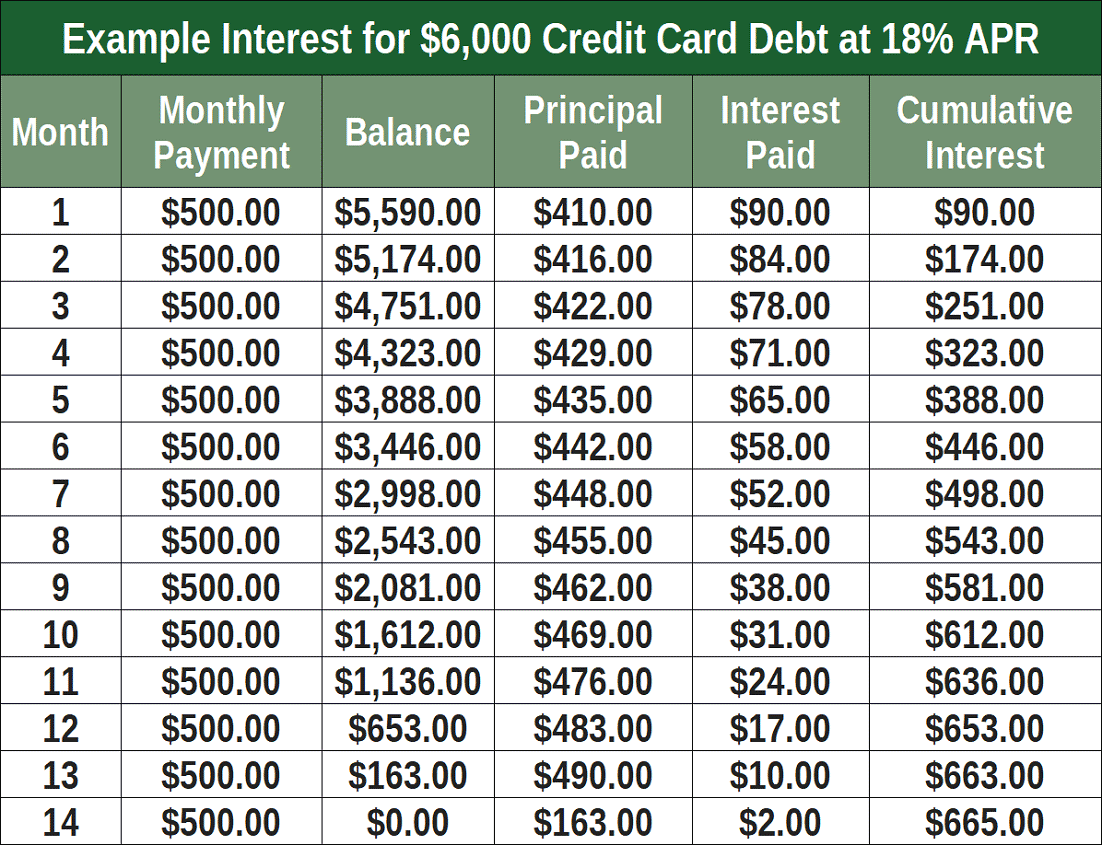

The speed is frequently much lower than charge installment loans online Washington card or repayment financing costs, in addition to attention paid down is tax-deductible.

Security Outlines can be used for one purpose. Such as for instance, home improvements, automobile requests, and you may debt consolidating are common popular.

Like credit cards, your acknowledged Guarantee Range can be remain at zero balance whilst still being become leftover discover to possess coming unforeseen situations or economic problems, helping you get ready financially with a reduced-focus choice.

Earlier this day, the official folded from the the fresh Allowed Home Ohio system to help you improve the housing stock from inside the organizations about condition. This information provides facts about the program and exactly how certified organizations can use to possess give funds.

What is the Acceptance House Ohio Program?

The new Enjoy Home Kansas program provides fund toward creation of owner-filled housing products across the condition. It has about three parts: Buying, Rehab/Framework, and you may Income tax Loans. The program try financed because of the Kansas General Installation getting $100 mil in offer finance and you can $fifty million inside income tax credit more than two years. Anticipate Family Kansas finance will be along with most other provides and you can tax borrowing programs.

Purchasing: Grant fund is issued to afford price of buying a great qualifying residential property. The house must have an existing domestic structure, has at the very least step 1,000 sqft out-of habitable place, and certainly will end up being a foreclosures or old-fashioned purchases.

Income tax Borrowing: An income tax credit is actually granted for the private customer because the belongings could have been marketed. The home need to be owner filled and get at the very least 1,000 sqft from habitable space. It may be a single relatives, duplex, triplex, fourplex, townhouse, line household, condominium, otherwise modular domestic. The fresh qualifying client need certainly to earn 80% AMI or shorter and stay the main tenant for at least 5 years. You will have a good 20-year action maximum requiring one upcoming purchasers end up being at the 80% AMI otherwise less than in the duration of profit.

*Electing subdivision: A civil agency who’s introduced a regulation or an effective township otherwise state who has accompanied a resolution away from adopting and implementing steps in order to helps the brand new active reutilization from nonproductive home mainly based contained in this its boundaries.

How much is my personal endeavor qualified to receive?

Purchasing: There’s absolutely no limit limit to the pick. $25 million is present for every financial 12 months and you may excess fund can become rolling over.

Rehab/Construction: A maximum of $31,000 for rehabilitation otherwise structure per being qualified house. $25 billion is obtainable for each and every fiscal season.

Income tax Credit: $90,000 otherwise 1 / 3rd of price of rehab/structure is present for each and every house. $25 mil is obtainable per financial season.

Who can this option work with?

Most of the elements of Allowed Household Ohio can benefit property finance companies, homes reutilization corporations, and you will electing subdivisions. The brand new tax borrowing from the bank role also can work with qualified designers, as well as nonprofit organizations.

What is the applicant guilty of?

The fresh new candidate could be accountable for money-being qualified the new people of your features, financial counseling, keeping track of your assets remains proprietor occupied with the very first five decades and you may money limited on basic 2 decades. Consequently the brand new applicant could well be committed to a great 20-season connections to your panels.

What are the penalties having noncompliance?

Into the Taxation Borrowing from the bank program, in the event that a property is not marketed to a qualified buyer otherwise instead an action maximum, the applicant need pay-off every loans obtained.

Should your homebuyer cannot occupy the home for 5 decades immediately after pick, the newest homebuyer will be responsible for paying $ninety,000 faster by 20% per full 12 months they occupied the house.

In case it is learned that paying off perform impose a hardship toward the vendor, Creativity has got the authority in order to waive penalties on the homeowner. Homeowner adversity get cover factors instance breakup, impairment, disease, loss of income, or other documented difficulty one to gets acceptance regarding Advancement.Ideal away from Means

Siz de fikrinizi belirtin