- Experts searching Va compensation to possess service-connected disabilities.

- Pros that eligible to located settlement to have services-connected disabilities when they did not discovered retirement shell out otherwise active service spend.

- Pros who happen to be rated by Va since eligible to receive settlement because of pre-launch handicap examination and you will get.

- Enduring spouses out of veterans just who died operating or of provider-connected handicaps (in the event such as enduring partners are pros through its own entitlement and whether they are using her entitlement into financing).

Va Debt-to-Earnings Proportion and you may Continual earnings

It would take a look that with the zero downpayment ability out of the newest Va home loan, of many pros carry out think you can easily merely stroll from the financing when the moments get difficult. not, the residual earnings and you may obligations ratio rules utilized by brand new Virtual assistant underwriters prove this particular financing design can work. At this point, Virtual assistant mortgage loans feel the payday loan Stepney lower price from standard certainly the mortgage items.

Your debt in order to money ratio try claims that borrower’s complete financial obligation payments and also the recommended home loan repayments cannot be greater than 41% of your individuals monthly gross income.

The residual earnings advice determine the amount of money new debtor is always to have gone when they are making all of their debt costs. Which recurring, otherwise discretionary income, lets this new borrower to possess sufficient funds to control almost every other basics including clothes, dinner, transportation, and you will tools.

To-be reasonable for the borrowers, the remaining income requirements will vary considering a couple of items; how big is the household and the located area of the household.

It is possible for borrowers which have a financial obligation-to-earnings proportion significantly more than 41% to track down approved. To accomplish this, its residual income would have to end up being at the very least 20% greater than advised direction.

Virtual assistant Eligible characteristics

The latest Va financial system may be used towards the a variety regarding property systems. Listed here is a list of belongings that can be bought towards the Virtual assistant home loan

- isolated, single-home

- unmarried condo tool

- good duplex family

- an effective triplex home

- a four-unit house

- another type of design family

You’ll acquire a little, a lot more add up to be used in making minor fixes on the family or even to enhance the home’s energy savings.

The new Va loan now offers capital to own a wide range of services as well as single-friends homes, condos, 2-4 product owner-filled belongings, and you may the fresh new design homes.

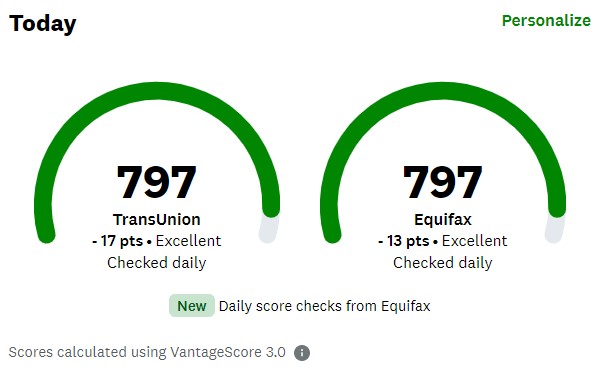

Va Credit rating

The fresh Va home loan guidance make it of numerous borrowers that have sub-standard credit to find acknowledged to own home financing. Heavy focus is positioned to your record since the current 1 year. As long as personal debt money for the past 12 months have been produced timely, the brand new seasoned has a good danger of bringing accepted to have a loan.

Va Certificate of Eligibility

The fresh new Certification out-of Qualification is actually a form about national you to definitely means the brand new seasoned has came across the service conditions towards the Va home loan. There are two main suggests an individual can get a certification out-of Qualification (often referred to as COE).

The simplest way to have the COE would be to get in touch with an excellent mortgage administrator that is knowledgeable about Virtual assistant mortgage loans and ask them to get the COE. Acknowledged loan providers can access a specific site and you can print the COE on the seasoned. This process can help you within a few minutes.

Additional way of getting a beneficial COE is to try to over form 26-1880. This form must be completed and therefore the bank normally fill out the form via the the second web site. The shape is pretty short, asking for earliest information including name, big date of beginning, street address, and you will phone number.

Siz de fikrinizi belirtin