- Published:

When you have a reputation less than perfect credit, you are curious how you can accessibility this new security into the your house. After all, you have made the resource of your house, and you will want the flexibleness one to a home guarantee range from credit also provides.

However, conventional banking companies often turn down applications out of borrowers which have lower credit results. What exactly will be the other choices having a less than perfect credit house collateral credit line?

Rating property Equity Credit line that have bad credit?

A house security personal line of credit (HELOC) works far in the same way due to the fact credit cards. Their HELOC will have a threshold, and you can withdraw from it anytime. The latest draws have a tendency to accrue appeal, immediately after which you’ll be able to create costs.

When you take out a beneficial HELOC, a separate mortgage is positioned on your property. This is also known as another mortgage. Their payment amount will vary with respect to the balance on your HELOC.

The advantages of an effective HELOC is that, unlike other kinds of mortgage brokers, you can make draws and payments over and over. You need to use this new HELOC for everyone types of expenses, including:

- Do it yourself

- Unexpected expenses

- Personal bank loan debt consolidation

- Knowledge Costs

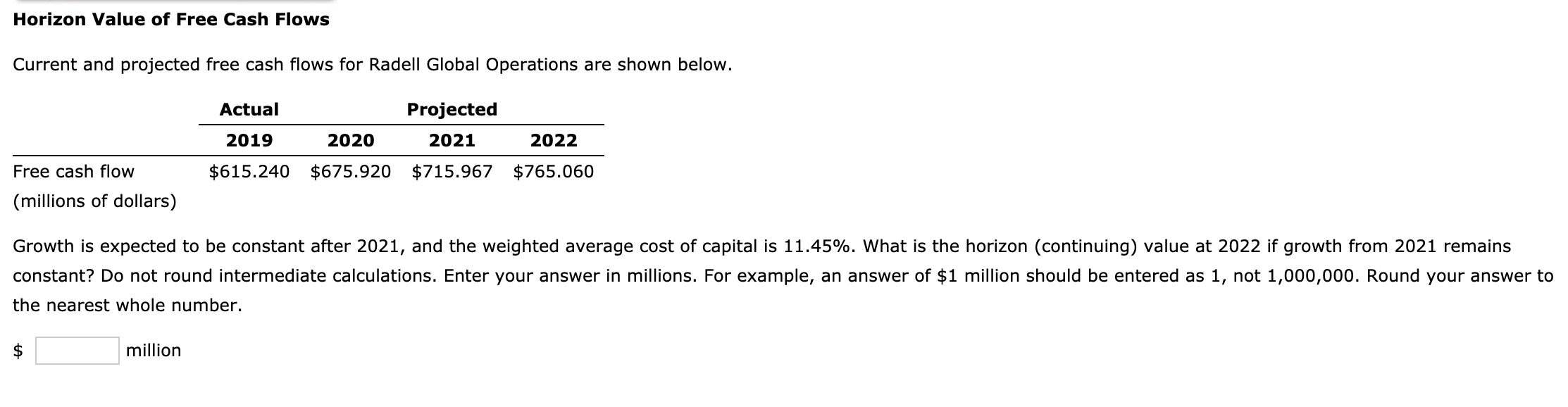

The level of their HELOC depends on how far guarantee is in your house. The guarantee ‘s the difference in the residence’s worthy of and just how much you borrowed on the mortgage. Different lenders will have various other constraints about how precisely most of your equity you can use for good HELOC.

Tend to a home Security Personal line of credit operate in Their Choose

Mortgage brokers, including HELOCs, are only concerned with exposure to own a loan provider. However, even although you has actually poor credit, the application possess other factors who leave you an excellent a good debtor for a great HELOC.

Having equity setting you need to use your home because collateral so you’re able to borrow. The greater collateral you’ve got, the latest less exposure your new home equity personal line of credit tend to feel.

Eg, a house well worth $250,000, which have a mortgage harmony due New York banks personal loans regarding $175,000. A loan provider might possibly be willing to give around 80% into a great HELOC, or as much as $200,000. Meaning you have got sufficient guarantee to own a $twenty five,000 HELOC.

Your income or other Obligations

If you have steady a job and enough earnings, possible inform you a loan provider that you could manage the brand new payments of another loan. This is particularly important that have a good HELOC since the number of brand new fee will vary each month, based on how far you’ve got drawn.

That have a low amount of personal debt, or reduced than the your income, is also in your favor. Your financial would like to make sure that you are at ease with an extra financing.

Less than perfect credit usually comes from the earlier, such case of bankruptcy or selections. When you have punctual previous costs, you will reveal that you are dedicated to meeting their obligations.

Financial Alternatives

When you is almost certainly not capable of getting a property equity line of credit from inside the Canada off a classic financial for individuals who possess poor credit, there are various other options.

Traditional finance companies have been called A lenders consequently they are probably exactly what pops into the mind after you think of home financing. But not, A-loan providers enjoys strict standards. If you don’t fulfill all of the criteria, you will not feel recognized for a loan.

Because the one of the many standards to possess an one financial is your credit rating, a less than perfect credit get can mean you to a mortgage which have a keen A lender is not an option. The good news is, there are a few most other lending options.

B Lenders

A beneficial B Bank is a mortgage providers that’s funded as a result of low-traditional financing source but is nonetheless influenced by federal legislation. These could were trust organizations, borrowing unions, monoline organizations, and level dos banking institutions.

Sub-best identifies a borrower in the high-risk of maybe not paying down home financing. Solution B lenders have so much more constraints than simply A creditors however, was alternatives for consumers having lower credit ratings.

Private Bank

A private financial support lender can also offer a home security range of credit and that is perhaps not ruled by government statutes. These types of might be joined firms or individual loan providers willing to provide fund in the place of rigid certificates.

Trying to get a house Equity Credit line having Poor credit

When you make an application for a great HELOC, you will have to likewise have some recommendations towards bank. This really is just like the date you taken out your own first mortgage. Specific data having available are listed below:

- Proof you own your home

- Proof of money or mind-a job income

- Details about very first mortgages, for example identity or amortization

The lender commonly assess your own residence’s really worth as part of your HELOC application to decide how much cash you can use. Simultaneously, the financial institution look during the a prospective borrower’s credit score.

By the shopping for a loan provider that actually works which have borrowers that have crappy borrowing from the bank, your raise your odds that app could be acknowledged. The borrowed funds equilibrium due on the first-mortgage will impact the amount you could qualify for. It also helps in order to assess the amount of guarantee you may have.

Your earnings is used to look at the financial obligation-to-money percentages on the software. Earnings confirms the monthly premiums you can afford and can make being qualified simpler.

Don’t let Bad credit Hold You Back

Your bad credit should not serve as a shield in order to leverage the fresh new security of your house. Whatsoever, you’ve put in the efforts to cultivate you to definitely guarantee, and you are entitled to so you can tap into it for your benefit. That has to express you can not use a credit line to help you change your own credit rating into the an optimistic you to?

If you find yourself trying to a property guarantee line of credit from inside the Ontario, enroll the assistance of a mortgage broker who will make it easier to speak about the choices that fit your circumstances most useful. Here at LendToday, we have been serious about hooking up your to your most useful financial for the economic circumstances.

Siz de fikrinizi belirtin