Ny (CNNMoney) — The newest Federal government towards the Wednesday in depth its most recent propose to help an incredible number of people refinance their mortgage loans so you’re able to today’s historically-lowest cost.

The program, and therefore needs acceptance because of the Congress, will allow individuals that happen to be most recent on the financial to save an average of $3,000 per year by the refinancing with the funds supported by this new Government Homes Government, with respect to the You.S. Agencies out of Construction and you can Metropolitan Creativity.

The master plan was estimated so you can cost between $5 million and you can $ten billion. To pay for it, President Obama said the guy doesn’t intend to enhance the shortage. Alternatively, he desires to demand a fee towards highest finance companies loan places Higganum — a shift that will possess a tough time making it prior people in Congress, who have refuted the thought of taxing banking institutions in the early in the day.

The fresh new refinancing bundle is the most recent during the a set off programs built to assist resolve the nation’s property good shared the house Reasonable Modification Program (HAMP) foreclosures avoidance efforts and very quickly used up with the home Affordable Re-finance System (HARP), which helps home owners which owe more on their houses than simply it can be worth refinance its finance. However the applications, hence tried to simply help 8 to help you nine mil homeowners exactly who keep fund off government-supported Freddie Mac computer ( FRE ) and you can Federal national mortgage association ( FNMA , Chance 500), has helped only some dos million at this point.

What’s different about it latest proposition is that it might assist borrowers which have private, non-regulators loans exactly who cannot see the fresh new refinanced fund from inside the the past while they due more on the mortgage loans than their homes had been worth.

“When you find yourself under water compliment of no-fault of the and can’t re-finance, this plan alter that,” Obama said in the a presentation inside Drops Church, Virtual assistant. For the Wednesday.

Enjoys Obama’s homes coverage were not successful?

Getting qualified to receive brand new refinancing system, consumers shouldn’t has skipped a mortgage percentage for at least six months and have now just about one later fee when you look at the new half a year in advance of you to. Nevertheless they must have a credit rating regarding 580 otherwise finest, a limit the administration claims 9 out-of ten borrowers see.

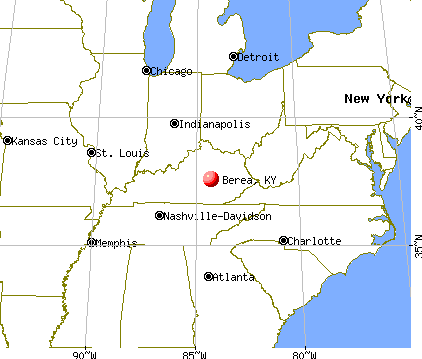

The newest borrower’s home loan equilibrium and additionally try not to go beyond the loan constraints to have FHA-covered finance within their groups, starting from $271,050 in lowest property rates portion so you can $729,250 within the large-pricing ones. Nevertheless they need individual and you may invade your house protected by the latest financing.

Brand new administration desires the applying to incorporate a provision demanding lenders for taking a “haircut” because of the recording financial balances of profoundly underwater finance — those people whose individuals are obligated to pay more than 140% of their current home prices. By doing so, it can help reduce the danger the debtor have a tendency to standard, the brand new government told you.

Because of the refinancing towards straight down interest loans, mortgage borrowers you certainly will drastically beat its monthly obligations. Of numerous create change from expenses 6% or higher to regarding the cuatro.25%. Into the a $two hundred,000 equilibrium, who save your self about $216 1 month to the a 30-season home loan.

The applying will additionally provide a choice to allow it to be borrowers to help you refinance on 20-seasons fund. Such doesn’t always dump monthly installments however, tend to permit individuals to construct domestic equity more quickly and enable them to wind up paying down the newest finance eventually.

Foreclosures: America’s hardest strike areas

Brand new management wishes home owners to take that choice that will be proposing that FHA pay closing costs so you can prompt them, which would bring about a supplementary average savings of about $step 3,000.

This newest step earliest emerged inside the past week’s County of your own Connection target, if president told you however launch an application that will rescue consumers thousands of dollars annually by permitting these to refinance on finance in the newest low interest rates.

The fresh new chairman said the program try an attempt to aid strengthen brand new housing industry, and after that the benefit. The three.5 billion residents the program goals commonly within the default, the fresh government said, additionally the cash freed up could result in so much more user spending.

Siz de fikrinizi belirtin