Whether or not home business money are hard to track down largely relies on your specific team and you will finances, and you can which type of financial you find yourself working with.

Discover valid reason advertisers often envision small company fund is actually difficult to get. High banks merely environmentally friendly-white from the 25 % of its loan requests, which means a huge portion of individuals end up getting zero financing.

As well, business owners are apt to have a less strenuous time handling community lenders such as for example CDC Small company Loans because their certificates try faster rigid. That’s because these faster, non-bank loan providers offer funds backed by the latest U.S. Small company Management, otherwise SBA. This enables way more autonomy so you can lend to help you a bigger pond regarding entrepreneurs and additionally people who have all the way down credit ratings and you will startups.

However some will get understand bringing a small business mortgage as actually difficult to get, there are many different facts you could potentially handle to boost the possibility of getting funded.

Fix people borrowing from the bank-declaration issues now

Have you figured out your credit rating? It should be the most important count of several lenders will work at in financing procedure. Between three hundred in order to 850, traditional financial institutions always would like you to have a good 680 or maybe more. At CDC Small company Financing or any other society loan providers, the target minimum is 620 – either smaller.

The greater your credit rating, the greater your chances would be from the protecting a company financing. In addition, highest fico scores can help you secure top pricing, meaning that more money on your own pouch over the years. Loan providers deeply value it count since it informs her or him exactly how credible youre within investing your debts on time, or after all.

Do your credit score you prefer an enhance? Because of the repairing preferred things and you may errors on the credit report, you might increase your credit rating so you can be eligible for financing. You happen to be astonished. Normally, some one get a hold of problems or dated suggestions in their credit reports that is hauling down their get. Don’t let you to definitely end up being the circumstances to you.

This can be done all by yourself without the need to hire a credit-repair company. Undecided how to start? Invest simply dos-ten minutes of your energy in order to dive with the our borrowing-fix video clips show.

Show loan providers you’ve done your quest

Surely you could potentially confidence your friends and relatives so you’re able to vouch to suit your character, correct? Really, in the wide world of business credit, the best feedback are from debt information.

Have you been a preexisting entrepreneur applying for a business financing? You ought to render the income tax records recorded on the prior 3 years. Loan providers also want observe an interim statement of finance, that’s essentially your debts layer and you can cash losses statement.

Data showing your business’ show throughout the years plus debt agenda are usually requisite. Once more, these are important since it will help loan providers top discover your online business and just how its doing – before providing one resource. Together with top you appear in writing, the higher the probability can be found in getting financed.

Will you be a business team? Anticipate to offer a corporate package and monetary forecasts. ( We have found an excellent 1st step: https://paydayloancolorado.net/cascade-chipita-park/ Follow these 6 business strategy 2 and you can don’ts .)

Request help from those people who’ve been around, done one

You will possibly not getting some indeed there when it comes to writing a corporate bundle. Or maybe pull up-and evaluating your credit score may seem overwhelming. Such thoughts are common and you may totally regular.

Thankfully, there is no decreased professionals who normally direct you from creating works you to goes into and come up with a business-financing procedure simpler and you may challenge-free. Listed here is an example away from organizations that may yourself help you:

Small business Invention Centers, otherwise SBDCs : Company from totally free training and you can team instructions so you can aspiring and you may early-stage entrepreneurs. It help small enterprises navigate topics plus providers certificates, it allows, marketing research, team considered, budgeting, web development and. Come across the local SBDC here .

Rating : The greatest system out-of volunteer business coaches on You.S. They’re going to few you with a teacher on your specific community for lessons, at no cost for your requirements. Get a hold of the local Get part here.

Ladies’ Providers Centers : Will bring free otherwise low-prices qualities geared toward lady entrepreneurs in every stage. To track down your neighborhood Women’s Business Center right here .

Organization telling : Rather than conventional banking companies, CDC Business Fund even offers see prospective clients totally free organization lessons ahead of, after and during the borrowed funds techniques. We provide one to-on-that properties plus breakdown of financials, business-package composing and you can referral to help you characteristics

The essential difference between SBA funds and online-simply loans

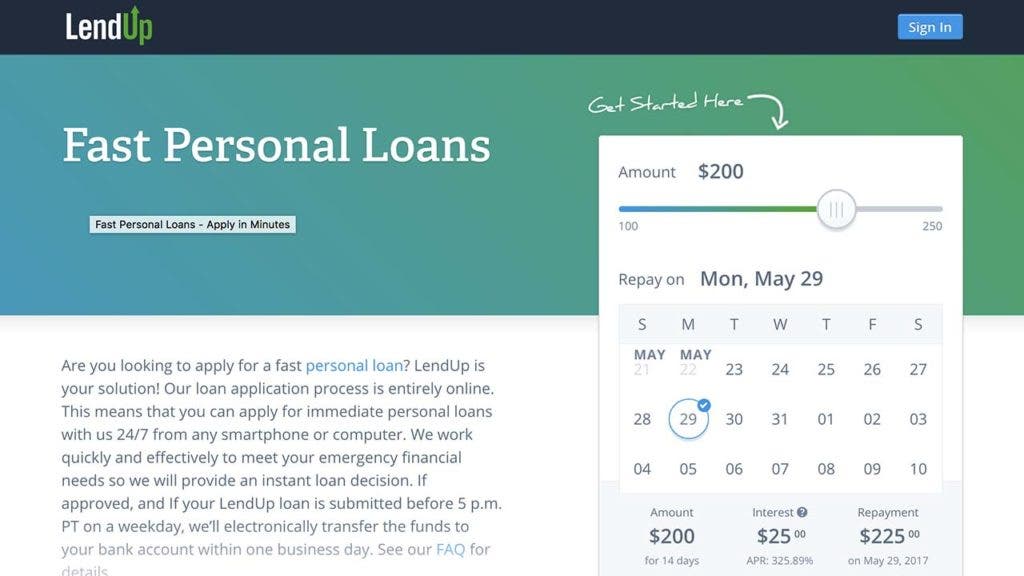

When the put smartly as well as for extremely particular causes, they could be good financial support for your requirements. However, most of the time, small enterprises whom use these funds face monetary demands. Chief one of them ‘s the high odds of investing APRs, otherwise yearly attention, as much as 150%. An annual percentage rate it highest is also eat into the money and you will compromise the healthiness of your online business.

When you find yourself SBA-recognized funds perform take longer so you can process, you can rest assured you will be considering a fair rate you are able which have glamorous words. In fact, because a residential district-oriented bank and individual recommend, we’ll only provide funds in order to borrowers that are sustainable and you can sensible.

Need to find out about brand new pledges and you can problems away from online-only loans? Scan our very own interactive age-guide at the top concerns to inquire about when it comes to one here.

CDC Small business Finance was a community bank one to pays attention to help you an enthusiastic entrepreneur’s entire facts in the place of concentrating on just the tough numbers. That’s what vitality the method of lending so you’re able to small enterprises inside California, Arizona and Las vegas, nevada.

Siz de fikrinizi belirtin