A beneficial mortgaged building was a secured asset for many of us and enterprises. Finding out how an excellent mortgaged strengthening is taken into account towards the balance piece is critical having monetary revealing and you can taking a look at a keen entity’s monetary fitness. Why don’t we glance at the idea of good mortgaged strengthening since an equilibrium layer asset and exactly how they impacts economic statements.

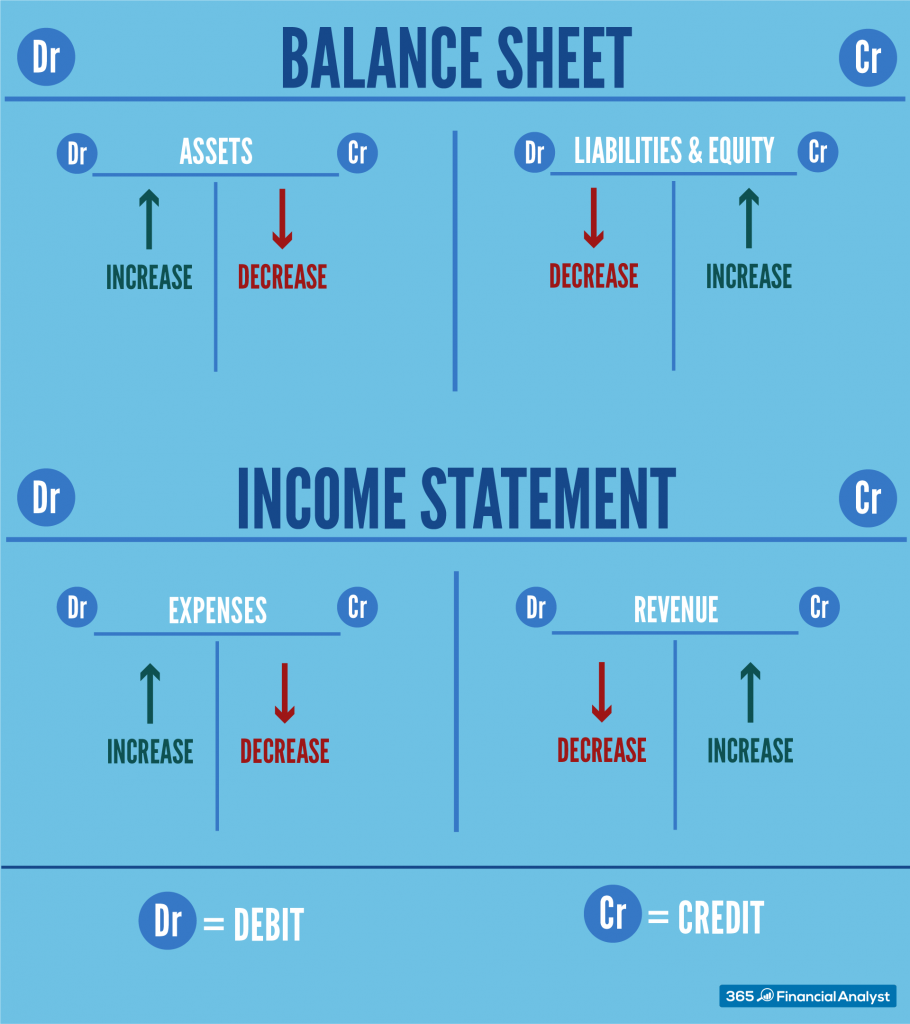

Analysts can be consider the fresh entity’s influence, debt-to-security ratio, and you will complete financial soundness by the classifying the fresh new building’s value given that a keen asset while the relevant mortgage as the a liability

The value of this building is actually said just like the cost of acquisition, with the price and one relevant deal charges. The balance layer after that reveals it value since a long-title advantage. With respect to the accounting methods made use of, the new fair market price of building or even the cost always expose its really worth.

A creating is mentioned given that an asset to the equilibrium layer if it is ordered that have a mortgage loan

For the harmony layer, an excellent mortgaged building often is categorized as the a low-most recent investment. Non-newest possessions can bring the business economic gurus more a longer time frame, generally speaking over a-year. That it relates to the structure because it’s an extended-identity investment. Newest property, such as for instance cash and directory, are claimed separately out-of non-current possessions because they can become transformed into cash within the pursuing the seasons.

The loan debt regularly find the strengthening is submitted due to the fact a responsibility with the harmony sheet as well using its detection while the a secured asset. The loan loan balance, also people accrued desire and you may relevant will cost you, is registered since an extended-label obligation. This accountability means the latest dedication to pay-off the mortgage over the desired go out, which https://cashadvancecompass.com/payday-loans-nv/ are often several years.

The newest monetary comments out of a corporate is generally impacted in the event that a good mortgaged strengthening is actually indexed due to the fact a secured asset towards the balance sheet. The building’s worth adds to the entity’s full resource base and you can brings up the total assets. The fresh new entity’s full obligations is in addition impacted by the home loan responsibility, that’s registered as the a lengthy-identity union. Once the equity relies upon subtracting complete possessions out-of complete liabilities, these types of changes tend to truly affect the security section of the equilibrium sheet. A home loan calculator can be used to determine brand new entity’s net worth.

Depreciation is represented to your income declaration once the a cost so you’re able to depict the fresh new gradual damage of mortgaged building. Depreciation charges imply the designated price of the structure more than the asked helpful life. New building’s carrying count on the balance layer try diminished by the newest yearly decline debts regarding building’s really worth. One financing charge or closure charges which might be the main home mortgage ortized about loan and you may shown since an enthusiastic amortization expenses on the money statement.

Financial data need a comprehensive knowledge of the latest building’s introduction towards the the bill sheet. They permits stakeholders, loan providers, and you can investors to assess an excellent company’s monetary balance and you may solvency. New building’s depreciation and you can amortization costs and additionally shed light on the new carried on expenditures obtain to preserve the new asset’s really worth and their effects to your earnings.

A developing having a mortgage are indexed while the a secured item for the the bill piece and is a large much time-identity money both for individuals and you may people. This new financial comments offer a genuine image of the newest entity’s economic problem by classifying the fresh new building’s well worth since an asset therefore the relevant mortgage loan just like the a liability. The brand new group, identification, and you can impact of good mortgaged building to the balance layer need to feel know to correctly declaration economic information, make choices, and you can take a look at an enthusiastic entity’s overall economy. Good mortgaged strengthening should have best accounting having economic comments so you’re able to end up being transparent and you will understandable.

Siz de fikrinizi belirtin