Some individuals check out refinancing a mortgage loan, that will bring much-requisite save in the form of quicker monthly installments. Regrettably, property owners tend to believe that a faster-than-excellent credit history status precludes all of them out-of capitalizing on the fresh refi experts. So, will they be right, incorrect otherwise someplace in anywhere between?

Whether a poor credit get ‘s the consequence of way too many looking sprees, traditions beyond an individual’s form or maybe just falling into hard times does not replace the facts you to definitely particularly a quality is a significant bummer

All the mature have good FICO get, which is essentially a quality get how good otherwise crappy a great individuals credit are. The number into the get try ranging from three hundred and you will 850, that have things lower than 669 sensed crappy otherwise reasonable (or since the loan providers desire to call-it, “subprime.”) This levels was designed to provide lenders a sense of exactly how more than likely a man will be to generate financing repayments on time.

What if their FICO score drops at the 600. Will it be a complete waste of for you personally to actually envision refinancing? “You’ll find loan providers available to choose from that may perform financing to consumers having really low Credit ratings, so there try loan https://paydayloanalabama.com/opp/ providers which wouldn’t,” claims La-centered Tony Garcia, market manager to possess Wells Fargo Home loan, listing one such as for example scores generally slip in five-hundred-600 diversity.

Garcia suggests bringing a no cost credit history before getting into this new refi processes which means you have a good idea out-of where the rating stands. Actually, it is essential to do that one time per year regardless of whether or otherwise not you intend to refinance while the report you will inform you ripoff (someone’s illegally starting accounts/accumulating expenses on your label), otherwise flubs, that are problems from businesses whenever putting together your own credit reports (reporting missed repayments which you indeed produced, as an instance). You can focus problems on credit scoring institution, that may certainly affect the score.

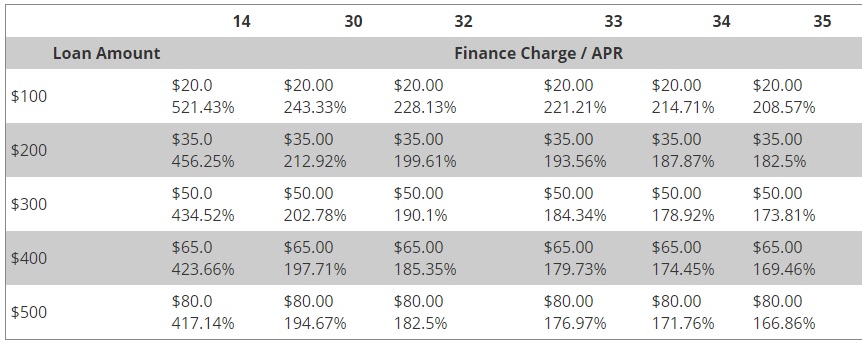

If the ensuing rating really does belong to the reduced variety, you can find lenders available to you who can still work with you, just like the Garcia noted. Although not, this new listing-low interest you to definitely way too many consumers see tempting will most likely not be on the latest table. “Regrettably, the low the financing rating, the higher the pace,” Garcia says. “When you yourself have a credit score that’s not fulfilling this new requirements out of federal and other financial institutions, you will want to predict probably that you might have to pay a little bit way more.” It’s also a smart idea to consult with leading loved ones otherwise family members to locate a lender who will take upright regarding the whether or not refinancing is a good idea at that time. If it is, Garcia indicates delivering around three quotes out-of around three some other loan providers to possess a solid idea on which to expect. You could find you to bank offers you a better interest than simply a unique.

If refinancing isn’t really throughout the cards right now because of a reduced credit history, do something to alter the issue. Start with making certain every site visitors, vehicle parking and you will library fees and penalties try paid down, and scientific debts. Any time expenses smack the collection stage somebody’s credit rating is inspired. Resist the desire so you’re able to maximum aside credit cards, and you will as an alternative adhere lower than 30 % of the overall limitation to exhibit in control expenses and you will an excellent pay designs.

As well as, it might seem wise to close vacant levels, but this is actually detrimental, given that fifteen per cent from somebody’s credit score lies in period of credit score. Navy Federal Borrowing from the bank Partnership implies putting some occasional small costs so you’re able to one or two largely bare accounts every once in the a bit, which means that your credit score can look a lot more solid and impressive. Carry out end beginning the new account before making a major pick, although not, since your credit rating was affected extremely slightly everytime one is exposed.

Very first, let’s explore just what bad credit is really

Just as in the majority of things credit-related, there’s absolutely no slashed-and-dried answer to even in the event anyone with less than perfect credit would be to refinance, but the chance is certainly there. Thus, you shouldn’t be bashful about investigating the choices.

Siz de fikrinizi belirtin