Searching for lower income homes within the La can seem to be including an enthusiastic impossible activity. Finding lower income casing in the Los angeles having solitary mothers? Even much harder. The house to find processes is tough adequate though you are not looking to boost a family group alone simultaneously.

More over, of a lot solitary moms and dads find themselves that have less than perfect credit or low income having explanations that will be totally beyond the control. Insufficient time and energy to really works otherwise outstanding personal debt away from legal fees could possibly get wreck havoc on homebuying preparations.

Not worry! Low-earnings homes in the Los angeles getting single parents can be found and you may affordable. Once you know where to look because of it and how to submit an application for it, you can purchase your dream house. That’s why i at your home Money For everybody provides come up with so it comprehensive investment guide for everyone in search of low-income property during the Los angeles having unmarried mothers.

We are going to safeguards the most obtainable home loans and you may finding an informed California household direction to possess solitary mom. Towards the end of blog post, hopefully which you are able to have all every piece of information you should begin interested in high low income construction.

Lower income Los angeles Home loans

Speaking of everything we take into account the most useful mortgage loans readily available for people in search of lower income houses within installment loans online in Maine the La to own unmarried mothers.

FHA financing to own unmarried mothers inside Ca

FHA were there to help since they’re in search of your own construction also. You realize why? Delighted group in their own home improve discount!

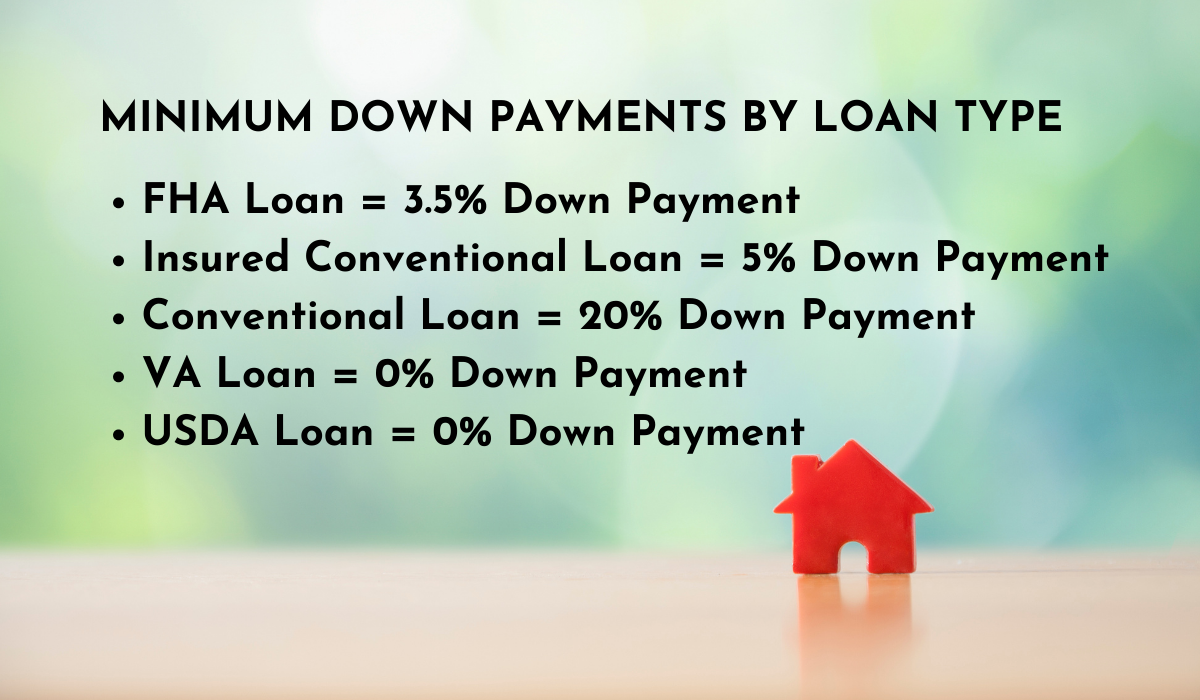

Extremely loans either provides a decreased deposit otherwise low borrowing criteria perhaps not one another. Private financial institutions and you may moneylenders believe that they should get one or the almost every other to offset the threat of a loan, and so the reduce your credit history is, more you will need to spend upfront.

FHA money is, as identity indicates, insured by Federal Property Government, an establishment backed by the efficacy of the united states Treasury.

For many who standard on the loan as you are not able to create most of the money, the fresh FHA pays back area of the financing so you can the financial institution.

Because this place are absorbing a number of the risks of the new financing into the lender, this type of loans feature lengthened eligibility criteria and you may bring you the fresh better of each other planets because of the merging low lowest borrowing from the bank requirements that have inexpensive down payments.

If you have an excellent FICO credit rating away from 580 or maybe more, you will only need to pay 3.5 percent of your own financing initial. When your credit history was at the very least five hundred, more you’ll have to pay is actually a 10 percent advance payment.

Combine that with longer earnings qualifications criteria, an optimum loans-to-money proportion out-of 50 percent (instead of the typical forty), and lower rates of interest, and you’ve got a home loan system you can not be able to disregard!

Va and you may CalVet money getting single mom inside the California

Va money are covered of the a facilities of government regulators new Agency regarding Veterans’ Products, otherwise VA. Due to this insurance rates, Virtual assistant fund need significantly more good-sized qualifications standards than just FHA loans.

They’re able to and save several thousand dollars as they require zero downpayment whatsoever and you will waive the personal Home loan Insurance requirement towards FHA and you will traditional finance.

CalVet fund are the same thing, besides they are insured by Ca Va as opposed to the federal equivalent.

The most significant basic difference between the 2 fund would be the fact CalVet mortgage brokers to possess single mothers usually have a bit down attention cost. It is saving you a little bit of currency through the years.

Siz de fikrinizi belirtin