This informative article discusses all you need to know about purchasing a good fixer-higher house. Homebuyers can buy manager-occupant number one fixer-higher recovery finance having FHA, Virtual assistant, USDA, and you can conventional fund. Many homebuyers thinking of buying, rehabilitation, or remodel their houses . FHA 203k money was to own holder-renter home just. FHA 203k funds endeavor to service people in their operate so you’re able to refresh its areas.

FHA 203k finance try to have homebuyers selecting homes looking for repairs or upgrades. Its a mixed buy and you can construction financing that have a good step 3.5% downpayment of your increased well worth.

FHA 203k loans are very popular loans to possess homeowners to invest in an excellent fixer-higher family. not, FHA 203k loans are only to have proprietor-occupant property and never investment functions. The brand new continues can be used for both the pick and you may rehab loan amounts. FHA 203(k) loans are also for people who must re-finance their homes and you will purchase solutions. Capable re-finance the established financial and have now a much bigger mortgage filled with the building will set you back. In the following paragraphs, we will security to invest in a good fixer-top house with FHA 203k fund.

Benefits associated with Buying a beneficial Fixer-Upper House

To acquire good fixer-top home is quite popular certainly one of a residential property investors and you will an excellent rewarding opportunity, but it addittionally boasts challenges. In the following paragraphs, we are going to explore particular methods to adopt if you’re considering purchasing an excellent fixer-upper house. Dictate the acquisition prices along with your recovery budget.

Rating prices estimates. Receive multiple rates out-of designers and tradespeople into performs your want to do. This should help you finances way more accurately and prevent unexpected costs.

Just before thinking about fixer-higher residential property, dictate the purchase and you will repair will set you back. Be sure to factor in the cost together with costs of fixes and you may renovations. Determine what we wish to achieve on fixer-top. Looking for a home to reside, flip getting cash, otherwise rent out? Your aims will influence your method to renovations plus the finances your put.

Delivering Pre-Approved Buying good Fixer-Higher Household

Delivering pre-approved to have a mortgage is the initial step for the to buy an excellent fixer-top domestic. What kind of fixer-higher family are you to find? Would it be a holder-tenant domestic? Could it possibly be a financial investment home? Is-it a fix-and-flip home?

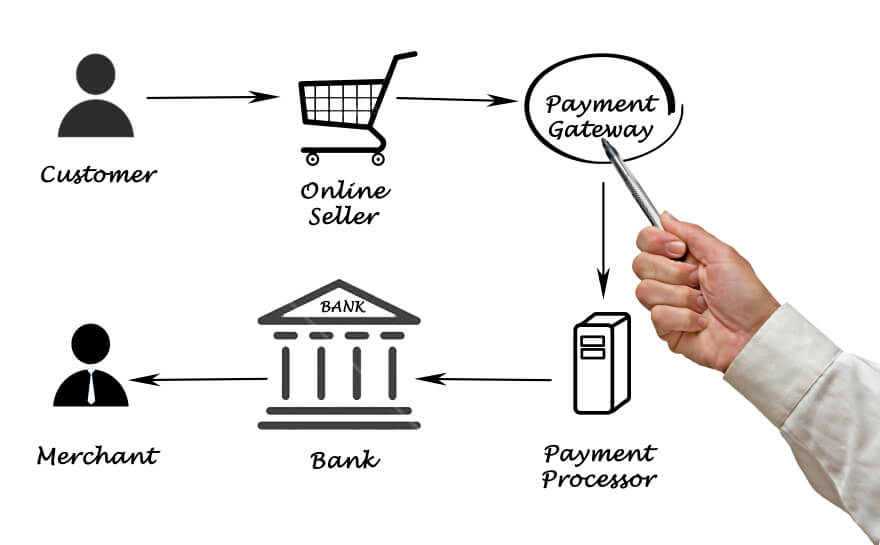

There are various choices loans in Oscarville for investment an effective fixer-higher domestic. If you plan to invest in the purchase, score pre-acknowledged having a home loan which means you know how much you might use.

This should help you narrow down the choices and then make more told decisions. Remember that to acquire a beneficial fixer-top are going to be labor-intense and you will financially demanding, it is therefore vital to become really-waiting and have a very clear plan. If you would like become more experienced in family renovations, imagine hiring benefits or contacting advantages to help direct you.

Look Place To order good Fixer-Upper Household

Check out the market where you are interested. View possessions values, area trends, as well as the prospect of future adore. Focus on a real estate agent proficient in to order fixer-uppers. Real estate agents can help dealers see functions, discuss sale, and gives best spot for an educated possible fancy. You don’t wish to spend excess on home and stumble on renovation overruns.

Reason behind contingencies when looking to buy a good fixer-upper domestic. Set aside a contingency fund to own unanticipated things while in the repair. It’s common having unforeseen troubles to enhance the overall costs.

Get a professional domestic inspector to evaluate the fresh fixer-top. Pick structural, electric, and you may plumbing system problems or any other significant issues. The fresh check declaration will assist you to imagine resolve will set you back significantly more precisely. Negotiate the cost: In line with the assessment and your restoration bundle, negotiate the cost to your provider. They can be willing to lower the price or offer concessions so you’re able to be the cause of needed repairs.

Siz de fikrinizi belirtin