- Locking from inside the a good rate

- Overseeing financial manner

- Inquiring from the a lot more applications together with your lender

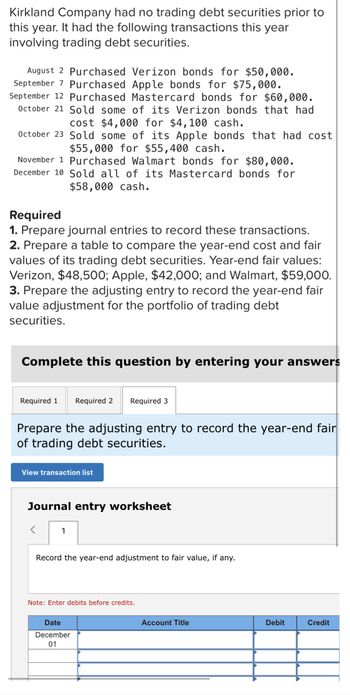

When you are consumers do not have the same quantity of handle as they have having a conventional mortgage, you’ll find steps the borrower may take to make certain they snag an educated speed and you can conditions predicated on their unique condition.

The first step is with which have a talented, reliable mortgage lender who’ll let suit your personal financial situation and you can desires toward correct loan options.

I hope becoming your ex lover and you will endorse throughout the every step, making certain you are aware this new terminology and you will requirements regarding the which financing.

- 62 otherwise older

- Residence is an important house

- HUD-approved possessions models, for example single-nearest and dearest property, condos otherwise townhomes

- Complete contrary mortgage counseling off an effective HUD-acknowledged counselor

- Extreme collateral of your house

- And one financial-based credit, money otherwise advantage standards

Remember that an other real estate loan does not end up being due until you escape, sell our home, pass away or are not able to retain the family otherwise pay fees and you can insurance rates. You may want to pay off the borrowed funds any moment for people who thus like.

If you were to think you be eligible for an excellent HECM, apply today with Compass Financial or e mail us on (877) 677-0609 to dicuss so you’re able to a loan manager.

Secret Takeaways

An opposite home loan is a kind of financing for people aged 62 and you can old. They lets you convert a portion of their house’s security to your dollars.

Particular requirements must be fulfilled to be eligible for a contrary mortgage, as well as buying home and achieving enough guarantee.

An other home loan helps you pay off obligations and you can live even more securely into the old age. But it’s crucial that you get the contract details before you sign into dotted range.

Associated Subjects

If you need additional money to pay for medical care can cost you and you can almost every other need through the later years, you will be wanting to know in the event the an opposing home loan ‘s the respond to. Taking right out a face-to-face mortgage is a big decision. Before you work, you should find out about just what an opposing home loan are and exactly how it truly does work.

What’s an opposing mortgage?

An opposing mortgage are a separate version of mortgage to have residents aged 62 and you can old. It lets you transfer the main equity on your domestic to your bucks without the need to sell otherwise make even more monthly payments. But unlike a normal house equity mortgage or next financial, you don’t have to pay-off the mortgage if you do not sometimes no lengthened utilize the home as your number 1 house-or you fail to meet with the financing obligations.

Contrary mortgage loans are designed for the elderly just who already very own an effective home. They usually have either paid down it off completely otherwise has tall collateral-about fifty% of your property’s really worth.

Discover different varieties of opposite mortgages with assorted fee measures, but most try House Equity Sales Mortgage loans (HECM). These types of loans are covered by Government Housing Management (FHA). The latest FHA retains strict opposite mortgage standards to greatly help cover both borrowers and you will loan providers.

How come an opposite financial really works?

An other financial are Maine loan and title a-twist for the a classic home loan, for which you take out a loan and you can pay their lender for every day. Having an other mortgage, you obtain that loan for which you borrow on the latest collateral of your home. There aren’t any month-to-month prominent and you can desire repayments. Instead, the mortgage try changed into monthly installments for you. It currency are able to be used to pay off debt otherwise funds crucial cost-of-cost of living instance as well as scientific debts. Opposite mortgages fundamentally aren’t employed for getaways or other “fun” costs.

Siz de fikrinizi belirtin