Simultaneously, think looking at their financial report frequently to make sure precision. Problems can take place, and punctually handling one discrepancies makes it possible to maintain a flush percentage record, then solidifying your creditworthiness.

The length of their financial also can play a crucial role for the influencing your credit score. Long-term funds, instance a 30-seasons financial, subscribe strengthening a long credit history, and that advantages their get over the years.

At the same time, because you advances from financial, your lower your prominent equilibrium, surely affecting their borrowing application proportion-a button reason behind rating computations. It slow reduced amount of loans not only displays your capability so you can perform much time-label loans but also reflects their dedication to monetary stability.

Furthermore, maintaining a home loan over longer can also render a good shield up against fluctuations in your credit history due to other monetary situations. For example, if you opt to accept yet another mastercard or a personal bank loan, having an extended-status financial will help balance your overall borrowing reputation, indicating as possible deal with several types of borrowing from the bank sensibly.

Problems and you can Cons

If you find yourself a mortgage normally definitely perception your credit score, this is simply not as opposed to their threats and you will possible disadvantages. Facts such threats enables best-informed conclusion out of homebuying. The excitement of buying a home will often overshadow this new economic responsibilities that come with home financing, so it is crucial to strategy it connection having a definite knowledge of the implications.

Dealing with americash loans Black Forest financial administration having caution will assist mitigate one undesireable effects in your credit reputation. It is necessary to just remember that , a home loan are a lengthy-term financial obligation, in addition to conclusion made during this time can have lasting affects on your own monetary health. Being hands-on in wisdom the mortgage terms and conditions will help your avoid problems that may occur out-of mismanagement.

When a mortgage Can be Decrease your Credit history

Home financing is decrease your credit score lower than specific situations. Mismanagement or shed repayments normally seriously damage the rating. Additionally, holding higher balances towards rotating borrowing from the bank immediately after taking out good mortgage can be negatively affect their application proportion. So it ratio is a significant factor in credit scoring patterns, and you will keeping a reduced application speed is crucial getting preserving a beneficial match credit history.

On the other hand, by firmly taking into a whole lot more debt than simply you could handle, this may boost red flags to help you loan providers, inside your creditworthiness and you can alternatives for coming credit. The pressure regarding balancing several costs can lead to economic strain, so it is much more challenging to keep up with mortgage payments. You will need to determine your current financial predicament and make certain you to definitely your own home loan suits conveniently affordable to avoid the potential to have monetary distress.

Mitigating Dangers toward Credit history

- Lay a spending plan and make certain home loan repayments fit within your economic plan.

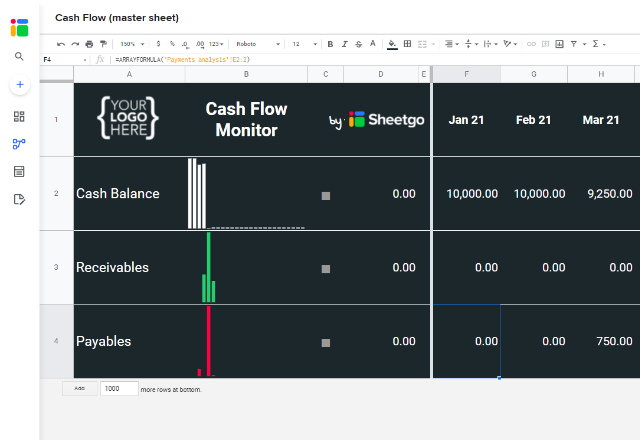

- Display screen your own credit daily to capture one circumstances early.

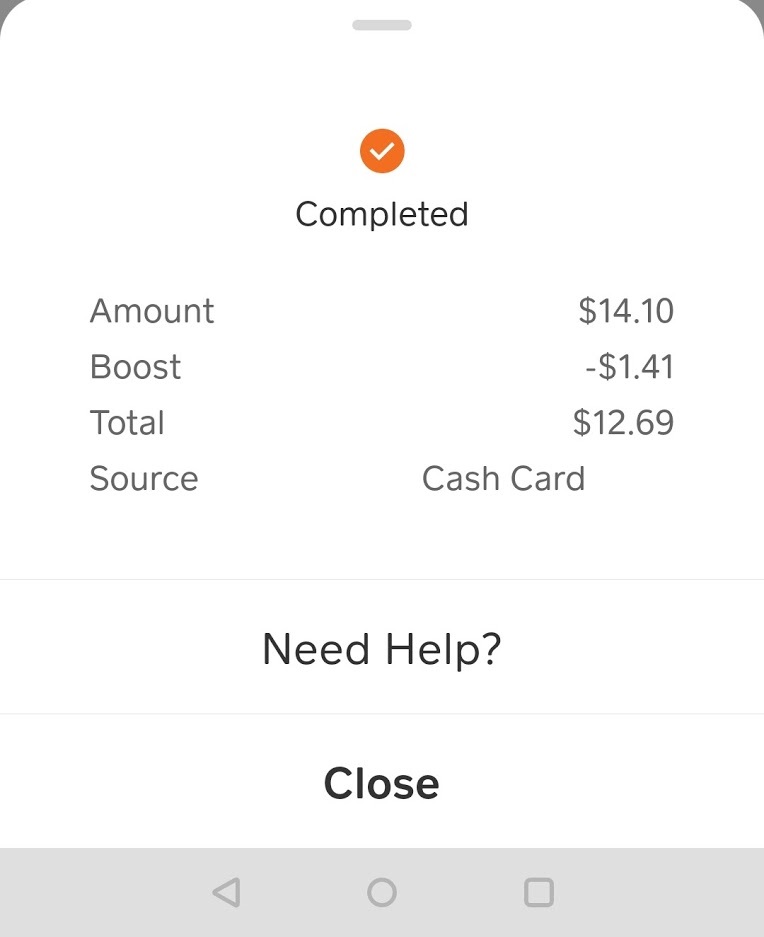

- Explore units such as automatic money to end later repayments.

- Limit new borrowing concerns to attenuate possible scoring affects.

Training these steps will help take control of your mortgage effectively whenever you are securing and you may boosting your credit history. As well, strengthening an urgent situation finance also provide a financial cushion in case unanticipated costs occur, making certain you might meet their financial loans rather than jeopardizing their borrowing from the bank. Also, seeking to information out of financial advisors or home loan professionals could offer expertise customized with the certain state, helping you navigate the causes from home financing confidently.

Trick Takeaways and you will Information

Bottom line, home financing can also be notably affect a person’s credit history, one another absolutely and you can adversely. They gifts a chance to build an optimistic credit rating, provided payments were created promptly and complete debt are addressed responsibly. The latest impact out of a home loan in your credit history is multifaceted; quick money can boost their score, while missed costs can lead to detrimental outcomes that may simply take age to fix. Knowledge so it equilibrium is extremely important for anybody considering home financing because section of the financial method.

Siz de fikrinizi belirtin