If you’re notice-functioning and don’t have all debt documents available, you happen to be qualified to receive a low doc financial . Loan providers that offer reduced doctor home loans will accept choice money verification actions such financial comments, providers craft statements otherwise an enthusiastic accountant’s letter in place of accomplished taxation yields. not, really lower doctor mortgage brokers requires increased put that are nearer to 20% of the home speed.

step 1. Start saving Would a consistent practice of putting aside normal offers for each and every spend cycle. Think about, when the time comes to try to get financing, providing facts you could responsibly manage money will assist your own loan application.

dos. Search exactly what government help is readily available If you find yourself a primary household client, you’re entitled to government assistance. Let getting earliest home buyers may vary ranging from for each state otherwise region. It may be that near you a federal government offer is actually only available for recently developed property otherwise up to a particular price point. It is quite worthy of exploring one stamp obligation exemptions otherwise concessions readily available.

3. Figure out how much you can obtain With a minimal put mortgage, your own deposit matter can sometimes determine how much you could borrow. However, your revenue will also contribute to the loan count, that will place the new budget for your house search. There are numerous handy on the web calculators that will help works your borrowing capacity for how much you get.

4. Get in touch with a reliable mortgage broker otherwise the lowest put financial financial For people who have only a small put and are not knowing which lenders bring reasonable deposit home loans, get in touch with an effective t rusted mortgage agent or large financial company . They’re going to assist you from the mortgage options available for your requirements based on their deals, your earnings and you may employment background. They’re going to even be able to suggest people regulators help you could possibly get be eligible for. During this period, we would like to rating pre-approval towards wanted loan amount early thinking about characteristics.

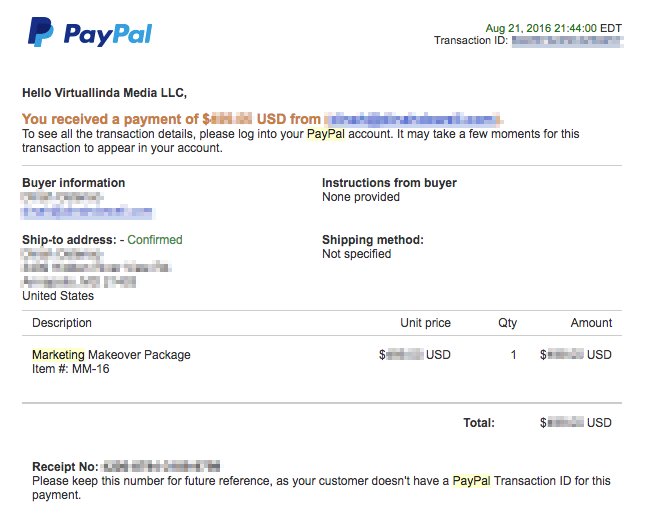

Your own bank provides you with a duplicate of your own files, for you to shop during the a comfort zone to have coming site

5. Pick a house otherwise money spent Work at a bona fide house representative discover a perfect home or money spent that you are able. Make https://paydayloancolorado.net/snowmass-village/ sure to make bring subject to loans. Your financial should approve the house or property ahead of if you which have any unconditional mortgage approval.

six. Promote any extra advice asked Don’t be concerned in case your financial requires for additional support recommendations prior to taking certified loan acceptance. It is well-known, particularly if it’s removed your extended to obtain that best assets. The lending company may charge you a current pay slip otherwise discounts declaration to ensure you are nonetheless in a position to accept the borrowed funds.

seven. Sign the required data and you will settle on the lower put household financing Immediately following formally accepted to possess the lowest deposit financial , all the people will have to indication mortgage data files. Make sure to understand such cautiously. Once your financial keeps affirmed any data can be found in buy, they are going to strategy a date to settle to the supplier. Everything you need to manage is actually strategy to grab the newest keys and you will relocate!

How to contrast lower put mortgage brokers?

There are many assessment other sites where you can examine brand new rates, has actually, and needs a variety of fund together with lower put mortgage brokers. It is essential to understand that the cheapest interest rate to the the market industry will most likely not always be the ideal mortgage to suit your facts. When looking for a decreased put home loan, we should think about the borrowed funds has actually readily available, if people financing will cost you is put into the borrowed funds and you will the fresh new lender’s song records, for example.

Siz de fikrinizi belirtin