If you feel you qualify for a consumer loan if you’re inside the Section thirteen, the first step is to find a loan.

You can make an application for an unsecured loan out-of one financial. However, their personal bankruptcy will in your credit history, and your credit history is likely to be dramatically reduced than just it was ahead of their bankruptcy proceeding. This may limitation one bad-credit signature loans and other style of financing getting less than perfect credit.

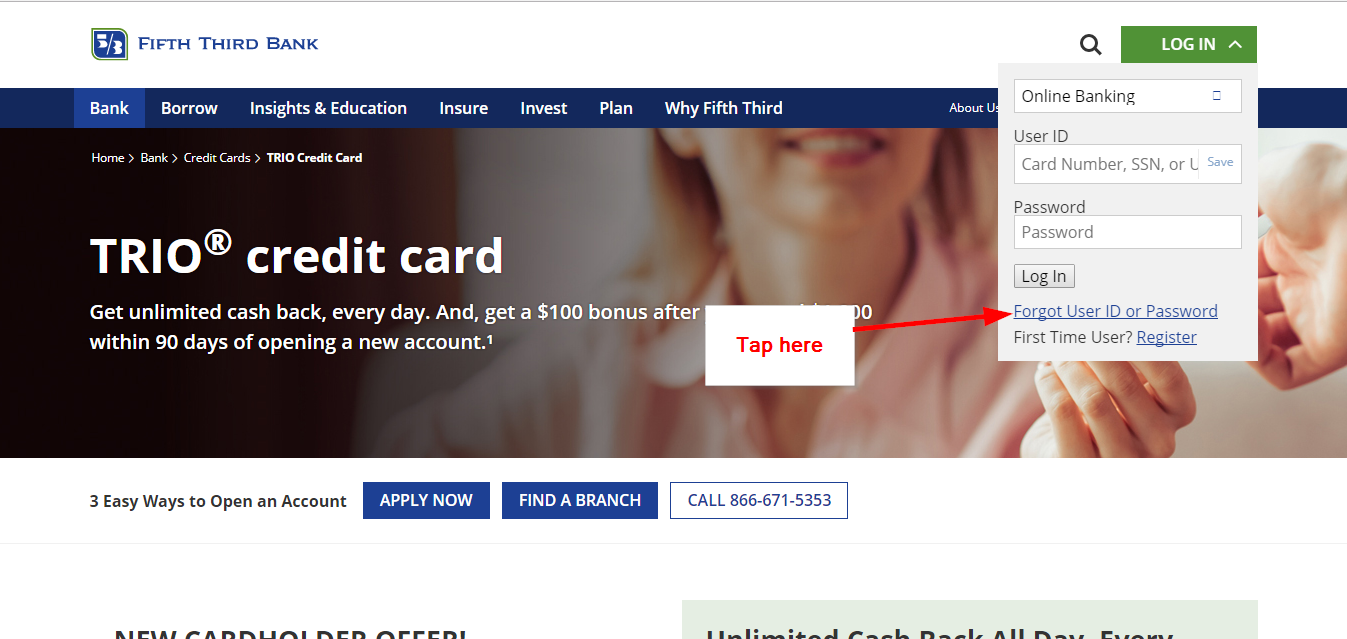

In any case, the process of making an application for a consumer loan is the same whether you’re in bankruptcy proceeding or not. An individual will be acknowledged for a financial loan, might found their finance and really should up coming pay back all of them with regular money over a set time period.

Bringing Consent in order to Sustain This new Personal debt within the Part thirteen

Second, you ought to rating consent regarding personal bankruptcy courtroom to carry out the borrowed funds. The actions for this vary from the judge, therefore you should check these with their lawyer. As a whole, not, you are going to need to:

- Rating a sample funding declaration from your financial one to lines this new financing words.

- Submit brand new Section thirteen trustee’s documentation, that’s generally speaking on this new trustee’s webpages. These models usually request you to justify precisely why you need to have the loan.

- File a motion requesting the fresh court’s consent so you can borrow funds and you will upload it towards the loan providers, the fresh new trustee, the latest U.S. Trustee, and every other curious people.

- You will need to visit an initial reading for the judge. Occasionally, the new court you are going to offer the actions rather than a hearing.

- In case the courtroom provides your motion, you must supply online installment loans direct lenders the financial a copy of one’s court’s acquisition. Loan providers must see which before approving the borrowed funds.

Understand that this is simply not a guaranteed procedure, so you might never be approved to the loan. It can take two weeks to endure the newest techniques before you could actually discovered acceptance.

It could be enticing to take out a quick payday loan if you find yourself you are in Section 13, however, payday loan are regarded as a kind of predatory lending and may even force you then towards financial obligation.

Choice in order to a consumer loan Through the Part thirteen Personal bankruptcy

The procedure is a similar when deciding to take aside whichever the financial obligation throughout the Section 13, if or not this is exactly an unsecured loan, a fellow-to-peer mortgage, or an auto loan. Some other trustees enjoys additional laws about what categories of personal debt you can take into the, so consult with your Section thirteen attorney before you apply when it comes to style of loan.

Although not, whenever you are against financial hardships, it has been best to renegotiate their Section thirteen arrangement in lieu of accept the brand new debt. The process for it relies on whether your troubles is small-label otherwise long-term:

- If you are up against quick-title trouble appointment your Part thirteen money, talk to your Section thirteen attorneys, who’ll just be sure to plan together with your Section thirteen trustee to delay your payments of the a couple months.

- In the event the problems be more enough time-term (for example shedding your job), an attorney could probably tailor the Chapter thirteen package which means you shell out shorter. You will most certainly have to are available in judge as part of which discussion.

Should i Rating a credit card Throughout the Section 13?

Youre generally prohibited from taking on any the latest personal debt if you are within the Section thirteen if you don’t have a pressing need. When the a loan helps you pay your financial situation, including if you like a car loan to find an effective the brand new vehicle to go to try to secure earnings, it’s possible that you might be permitted to deal with way more loans.

Siz de fikrinizi belirtin